In this auspicious occasion, we are delighted to delve into the intriguing topic related to Will 2025 Be a Good Year for the Stock Market?. Let’s weave interesting information and offer fresh perspectives to the readers.

The stock market has been on a roller coaster ride in recent years, with ups and downs that have left investors wondering what the future holds. After a strong performance in 2025, the market took a downturn in 2025, with major indices such as the S&P 500 and Nasdaq Composite Index posting double-digit losses.

As we look ahead to 2025, investors are once again asking the question: will it be a good year for the stock market? While it is impossible to predict the future with certainty, there are a number of factors that suggest that 2025 could be a positive year for investors.

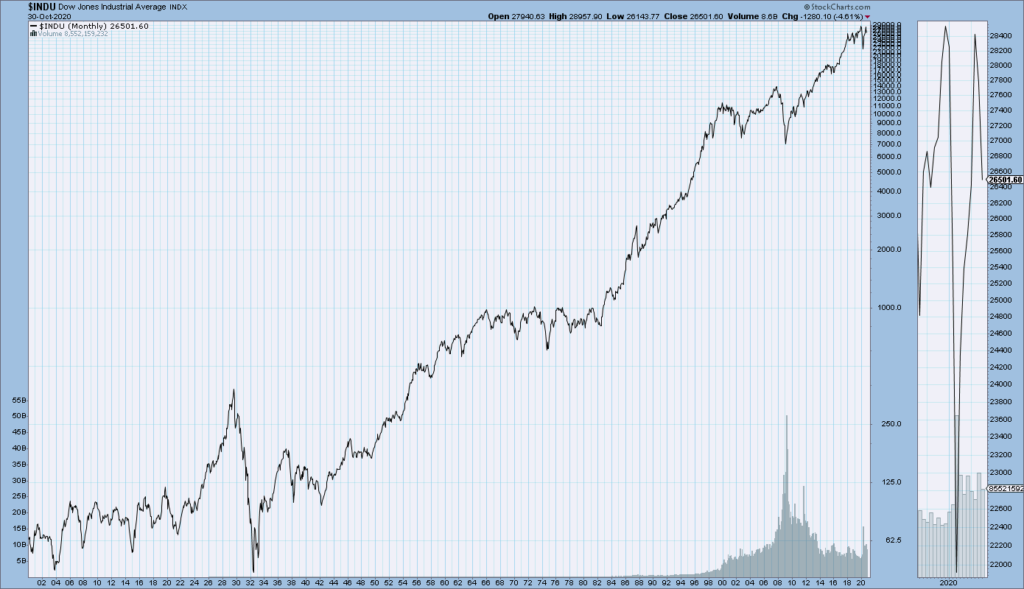

One of the most important factors to consider when forecasting the stock market is economic growth. A strong economy typically leads to higher corporate profits, which in turn can drive up stock prices.

The U.S. economy is expected to grow by around 2% in 2025, according to the Congressional Budget Office. This is a modest growth rate, but it is still enough to support corporate earnings growth.

Interest rates are another important factor to consider when forecasting the stock market. Rising interest rates can make it more expensive for companies to borrow money, which can hurt their profits.

The Federal Reserve is expected to continue raising interest rates in 2025, but the pace of increases is likely to slow. This is good news for the stock market, as it means that interest rates will not be a major drag on corporate earnings.

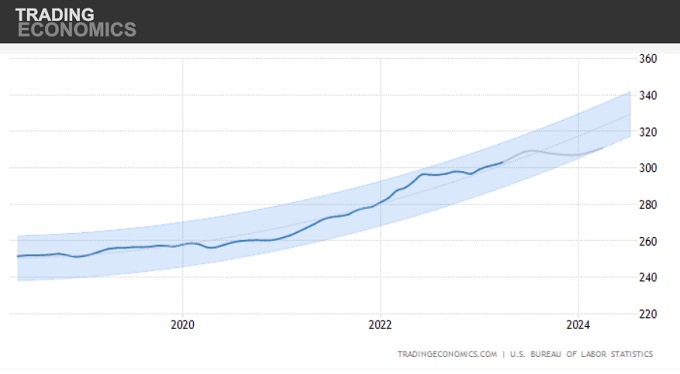

Inflation is a measure of the rate at which prices are rising. High inflation can erode corporate profits and make it difficult for investors to achieve real returns on their investments.

Inflation is expected to remain elevated in 2025, but it is likely to moderate from the high levels seen in 2025. This is good news for the stock market, as it means that inflation will not be a major headwind for corporate earnings.

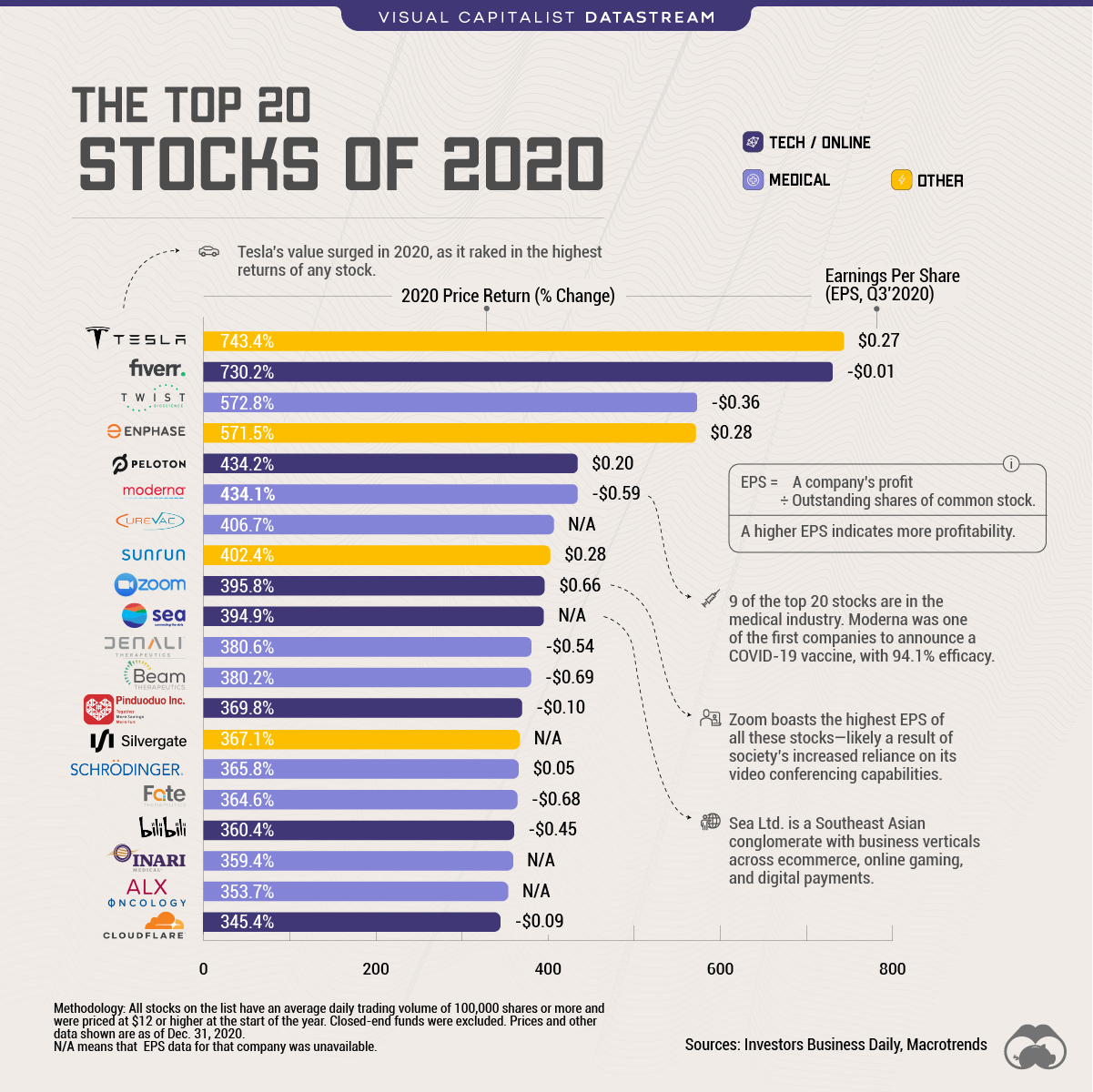

Corporate earnings are a key driver of stock prices. When companies earn more money, they can reinvest in their businesses, pay dividends to shareholders, or buy back their own stock.

Analysts expect corporate earnings to grow by around 5% in 2025. This is a solid growth rate, and it is enough to support a positive return for investors.

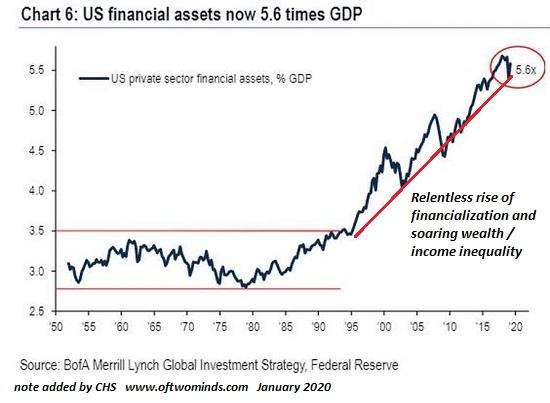

The valuation of the stock market is another important factor to consider when forecasting future returns. A high valuation means that stocks are trading at a premium to their earnings, which can make them vulnerable to a correction.

The stock market is currently trading at a relatively high valuation, but it is not excessive. This suggests that the market is not overvalued and that there is still room for further gains.

Of course, there are also a number of risks that could derail the stock market in 2025. These risks include:

It is important to be aware of these risks when investing in the stock market. However, it is also important to remember that the stock market has historically been a good investment over the long term.

So, will 2025 be a good year for the stock market? It is impossible to say for sure, but the factors discussed above suggest that it could be a positive year for investors. The economy is expected to grow, interest rates are likely to moderate, inflation is expected to remain elevated but moderate, corporate earnings are expected to grow, and the stock market is not overvalued.

Of course, there are also risks that could derail the stock market in 2025. However, these risks are outweighed by the positive factors discussed above. As a result, investors should be optimistic about the stock market in 2025.

Thus, we hope this article has provided valuable insights into Will 2025 Be a Good Year for the Stock Market?. We thank you for taking the time to read this article. See you in our next article!